HOME LOANS : Real Estate Platform for Customers to Purchase Houses

In today's world, many people (more than 1.6 billion) have no home and their own banks are unwilling to give them mortgages for several reasons such as previously unanswered credit payments for several days as borrowers forget to pay, immaturity in terms of age, rate of return, economic level, internal bank regulation, unpaid credit payment one month or more, early repayment of loan, failure to pay full loan, etc. In the second quarter of 2014, only 64.7% of Americans own homes, according to the United States Census Bureau, and 35.3% are tenants. In addition, the percentage of homeowners depends on age as only 35.9% aged 35 and below owns property, while 80.1% of people over the age of 65 have property. For this reason, financial institutions should carefully examine the trust of the borrower before giving them money. Also, credit scores, security checks, and credit history checks at the Bureau are examples of some procedures that financial institutions have set up so they can guide them to make decisions about lending or not. If deviations are found, the bank may decide not to lend money to the borrower, thus making many people with a bad credit history wondering if their mortgage lending requests will be approved.

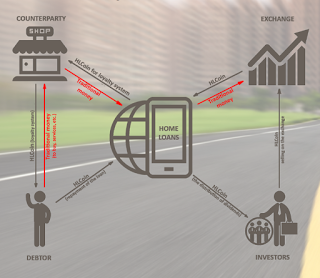

HOME LOANS is a platform for investing in loans secured by real estate worldwide, built on the basis of the Ethereal platform. The HlCoin Token Platform will be equipped with real estate objects and will be traded on the crypto exchange. HOME LOANS platform uses complex algorithms to predict the creditworthiness of all customers and only within 20 minutes the borrower can get their first loan to buy real estate in his life just from their smartphone. All customers have the ability to pay less interest and have higher credit ratings, if they use our platform more often. All aggregated Big Data and Credit History is stored in Blockchain.

Our products.

International lending platform for real estate HOME LOANS provides types of loans such as:- Loans for housing under construction.

- Lending for secondary housing.

- Loans for commercial real estate.

- Loans for land acquisition

- Loans for own property.

Why Home Credit?

Borrowing system income for loan repayment: A HOME LOANS mobile application brings together a contractor-in-one product that will motivate borrowers to purchase goods and services from partner companies, because CashBack systems and rewards are HLCoin currencies, in which the borrower will repay the loan.

HOUSING PURCHASE is an easy-to-use financial platform, where Investors from around the world can turn their savings into HLCoin, in order to increase revenues from secured loans by real estate, real estate sales and purchases and to protect their income from inflation. . 100% return on investment in case of failure of Guarantee Fund guarantee fund. The property remains in the SOME HOME balance or investor.

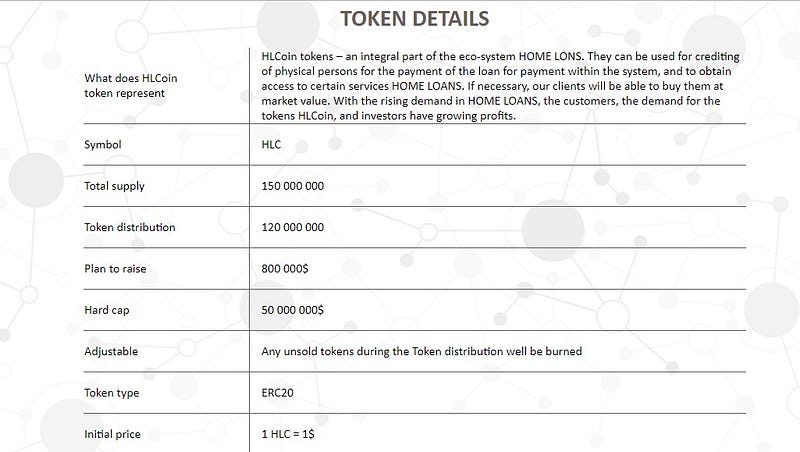

Token Details

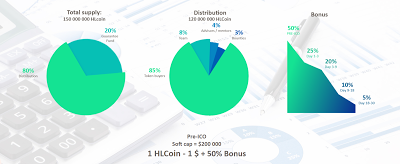

Token Distribution

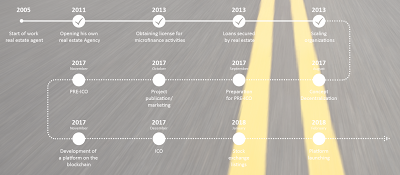

Road map

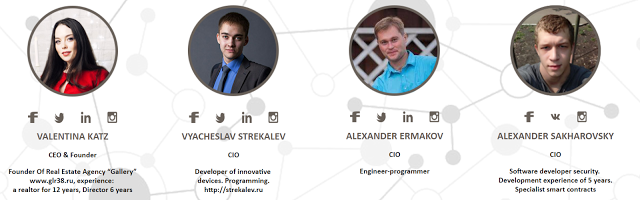

Team

Website: http://home-loans.io/

Whitepaper: http://home-loans.io/White_Paper_ENG.pdf

Facebook: https://www.facebook.com/HLCoin/

Twitter: https://twitter.com/HomeLoansCoin/

Telegram: https://t.me/HomeLoansENG

Author: gelefals

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1573104

Eth: 0x4151B9b20befFCc4fa6594e5e71F3cd405E6CF1f

Komentar

Posting Komentar