MUST-the first exchange in the world that gives investors access to real-time asset monitoring, cash flow and risk.

Cryptocurrency like Bitcoin or Altcoin seems good to be a worldwide exchange tool. Yes, forget about certain real currencies that are only available in certain countries. Along with the development of Internet technology, any transaction can be done globally by using it. Interestingly, not only is it more flexible to shop or buy something, it seems you should use Cryptocurrency in a smarter way. One of them is to use it as an object of trade and investment. So, how is it?

Of course, first of all, you have to join the Cryptocurrency site platform that allows you to do funding activities like trade and investment. It is very difficult, especially crimes such as fraud are quite common today. In the meantime, there are many sites out there that offer such facilities without you possibly knowing if it is valid or not. for this, it is recommended that you use "MUST". This is a type of Cryptocurrency platform with simple requirements, easy access, and lots of great features. This is even more interesting as consultations and discussions are available here to support you become more successful later.

The Universal Universal Transaction Standard (MUST) is the world's first stock exchange, which gives investors access to real-time asset, cash flow and risk monitoring.

Ecosystems MUST offer solutions - Evidence Asset Algorithms, which means in Instant & Sustainable Auditing of assets on a regular basis. Investors have access to an entirely authentic asset description of all of its properties, including current liquidity and market value and the quality of cash flows both when making a decision to invest, and at any time during the ownership period of claim rights.

The hallmark of the MUST solution is the fact that most of the work on the risk assessment and liquidity of smart assets, both at the stage of its formation and over the next time, is done by technology, not people.

Asset liquidity assessment systems and economic performance monitoring systems will ensure maximum transparency of the financing process for investors. Based on ratings and indexes, analytic and signal reports will be built using machine learning technology that will ensure maximum investment efficiency and reliability along with minimal transaction costs. The MUST ecosystem is a set of standards, rules and values that underlie any solution, product or service developed and implemented in an ecosystem.

Based on MUST standards, the team created a decentralized financing system for small and medium-sized businesses around the world, based on the tokenisasi end products and assets of the market being financed. The MUST system allows small and medium sized companies to receive financing for acquisition of the assets needed to produce the final product of the market.

Project target market volume MUST be 520 billion USD. According to low estimates, the project team plans the next 5 years to take 7.5% of the market and show a turnover of 40 billion USD.

This will be achieved through:

- Unique model of digital bond MUST Digital Bond and its circulation system on the MUST Exchange exchanges.

- A very lucrative time to enter the market, institutional institutions with financial constraints in IHR financing (AML, Basel II, Basel III).

- The development and decisions of authors in the field of digitalization and engineering and automotive equipment.

- The system ensures return on investment, built on the mechanism of tokenisasi kilometers and hours and asset monitoring.

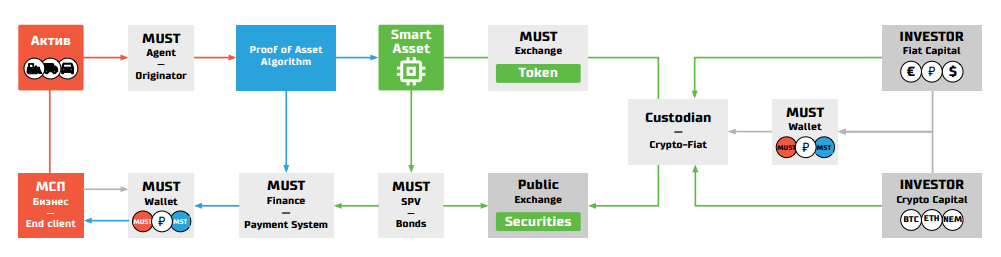

Ecosystems MUST

Based on MUST standards, our team created a decentralized financing system for small and medium enterprises worldwide, based on the tokenisasi end products and assets of the market financed.The MUST system allows small and medium sized companies to receive financing for acquisition of the assets needed to produce the final product of the market. An entity may acquire assets, judgments to be made in the final product unit of the market, and financing will also be provided in the final product unit. This approach allows the company to realize the final product, which will be produced in the future, and to acquire the assets produced for the production of this product.

MUST System Elements

In this system there are many different roles, b with the main business role are:

- End Client - End customers, SME entrepreneurs interested in getting access to financing. Owner of tokenized assets (Smart Asset).

- MUST Agent / Originator - Group services company MUST, acts as an operating agent in the tokenisasi transaction / asset securitization.

- Fiat Capital Investors - Private investors, banks or investment companies interested in investing in Smart Assets or Securities with certain profitability. This type of investor includes, among other things, the consumers of the final product.

- Crypto Capital Investor - Private investor, bank or investment company interested in investing Crypto Capital in Smart Assets with certain profitability.

- Smart Asset - Assets that are token, verified by the guarantor and connected to the monitoring system.

- Proof of Asset Algorithm - The unique algorithm of tokenization and asset securitization. Includes: Smart Asset Tokenizer and Smart Asset Escrow.

- MUST SPV - A specialized company, issuer of securities issued on the basis of tokenized Smart Assets.

- MUST Wallet - Service for fiat exchange and crypto currency for tokens MUST, MST, and KYC user identification in the system.

- Crypto-Fiat Custodian - Service that includes a number of solutions aimed at managing the "cold" storage of crypto assets of its originators, performing classical storage functions. Provide an opportunity to take crypto assets for accounting.

- MUST Exchange - Crypto-active exchange, the main purpose is the organization of transactions for the sale of token assets. The familiar exchange interface will quickly and easily begin using new financial instruments.

- * General Exchange - Classic exchange, which will trade securities issued on the basis of Smart Assets.

Products MUST

- MUST Renta - leasing services for SMEs.

- MUST Lending is a financing service (loan) secured by tokenized assets for IHR.

- MUST Escrow is a service to finance trade transactions through the tokenisasi assets to be financed under the transaction.

- MUST Digital Bonds (MDB) - Digital bonds issued in the securitization process, based on token assets and cash flows on them.

Token Holder

The token holder must have access to all ecosystem services and offers from a value-based economy. Token MUST grant the holder the right to discount when paying commissions on MUST Exchange according to the following schedule:

- HB - 2019 Q4 - 50%

- 2020 Q1 - 2020 Q4 - 75%

- 2021 Q1 - 2021 Q4 - 80%

- 2022 Q1 - 2022 Q4 - 90%

All tokens received by the MUST system as commission payments will be burned. After listing on the exchange, tokens MUST also be exchanged for crypto-active or other fiat currencies.

Number of tokens issued 500 000 000 Additional emissions not provided. And tokens MUST be issued according to the ERC223 standard on the Ethereum network.

Sales Token

- Pre-Operation Personal / 25.02 - 30.06.2018 /

- Bonus + 20%

- Public PreSale / 01.07 - 31.07.2018 /

- Bonus + 10%

- Sales of Public Token / 01.08 - 30.08.2018 /

- Bonus 0%

Fee Token

- 1 MUST = 0.10 USD

- Soft Cap = 6 700 000 USD

- Hard Cap = 35 000 000 USD

- Sales Token - 350 000 000

- Team - 50 000 000 (hold up to Q3 2019)

- Marketing & Advisors - 25 000 000

- MUST Foundation - 75 000 000 (hold up to Q3 2020)

Investment Distribution

- R & D - 15%

- Law - 20%

- Marketing - 60%

- Operating costs - 5%

ROADMAP

Q2 2015

Start

Start working on standard technology description;

Q3 2016

Prototype

The first version of the Inspect app;

Q1 2017

Auction Auction

and testing of business models;

Q3 2017

Rebranding

The first version of the market MUST.Ru;

Q3 2017

Presentation

The official release of MUST.Ru at COMTRANS 2017;

Q3 2017

Stock Exchange MUST

Launch MUST Checking Inspection Exchanges;

Q1 2018

MUST Renta RU

MUST Audit EN

MUST Price EN

MUST Check

MUST be Standard 1

Q2 2018

MUST Monitor EN

MUST Index

MUST Agent RU

SHOULD be a RU Expert

MUST Auction RU

Q3 2018

HAVE TO BE A Digital Bond

Must be changed

2018 Quarter

MUST Loan RU

Q1 2019

MUST EU Audit

MUST EU Inspections

MUST UNION EUROPE

MUST EU experts

MUST EU Auctions

Q2 2019

MUST HAVE EU

MUST be an EU Agent

MUST Monitor EU

Q3 2019

MUST Loan EU

Q4 2019

MUST Audit AF

MUST Check AF

MUST Price AF

SHOULD AF Experts

MUST AF Auction

Q1 2020

SHOULD Hire AF

MUST Agent AF

MUST Monitor AF

Q2 2020

MUST Loan AF

Q3 2020

MUST LAT Audit

MUST Check LAT

MUST LAT Price

MUST LAT Experts

LAT LAT MANDATORY

Q4 2020

SHOULD HAVE TO HAVE LAT

MUST be a LAT Agent

MUST Monitor LAT

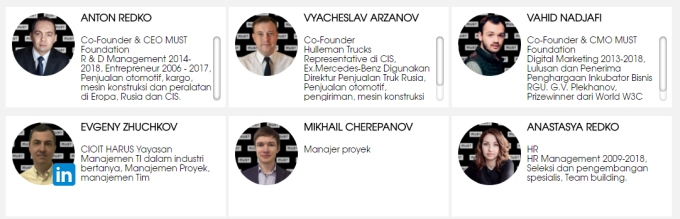

TEAM

Conclusions and References

In essence, it can be concluded that Must.io is the main standard of the main transaction for the economic value of micro, small and medium enterprises. Funding system available decentralized economic value of micro, small and medium enterprises through tokenization kilometers and hours.

For more information, you can visit:

- Website: https://must.io/

- Ann Thread: https://bitcointalk.org/index.php?topic=4509154

- White paper: https://must.io/whitepaper.pdf

- Facebook: https://www.facebook.com/mustfinex

- Twitter: https://twitter.com/mustfin

- Telegram: https://t.me/must_en

- Youtube: https://www.youtube.com/channel/UCE_f7jxOCOoGL3a0l73AUxQ

- Instagram: https://instagram.com/mustfinance

Author: jampang.kupret

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1573104

Eth: 0x4151B9b20befFCc4fa6594e5e71F3cd405E6CF1f

Komentar

Posting Komentar